Do it the right way:

WHY IS ACCNET ONLINE BETTER?

Watch what our CEO has to say

What are you getting for $39?

At AccNet, we don’t just punch numbers. We:

- Offer a complimentary consultation with our Accountant(s)

- Quickly and accurately complete your income tax return

- Find deep and hidden tax credits available to you, not normally available in automated software

- Measure your tax profile against new tax codes

- Process up to 10 medical expense claims

- Process any family allowance, disability claims, or moving expenses

- Verify your foreign income or foreign investments exceeding $100,000 CAD

- Apply all conventional tax codes

- Guarantee 24/7 Customer Service

- Eliminate the need for you to sort & organize your own documents

- Provide an online tax filing solution while you’re on the go

- E-file your taxes with the CRA, for free

Frequently Asked Questions (FAQ)

What does AccNet mean?

Many of our clients always mistake us for Accent. Our name is AccNet. It is short for Accounting Network.

Which provinces and territories do you support?

We support all of Canada, but we serve any client who does not reside in Canada yet has tax commitments in Canada.

I’m filing my taxes for the first time. Can I use ACCNET?

Yes, you can use AccNet.

I immigrated to Canada / emigrated from Canada during the tax year. Can I use ACCNET?

Yes, you can use AccNet.

I have a complicated tax situation. Can I use ACCNET?

Yes, we have expertise within our group specifically designated for dealing with complicated tax situations.

So, does that mean that you support things like business and rental income?

Absolutely, we also offer premium services like business pattern recognition and efficiency vs resilience patterns to help you identify where you’re not maximizing in your tax efficiency.

What can I not do using ACCNET (exclusions)?

We do not offer financial planning, investment advice, or tax law services. But we are partnered with some of the best ventures in each area to connect you with our trusted partners should you wish to use your AccNet sponsored tax efficiency to grow your refunds.

Can I use ACCNET to prepare a corporate T2 return?

Absolutely.

Does ACCNET support previous year tax returns?

Yes, we can go back as far as ten years.

Can I use ACCNET for free?

No, we do not value complimentary services unless you’re a premium client. Where we find ways to offer you complimentary value.

What supporting documents do I need when using ACCNET?

There are many documents required, and it can be different for each individual. As a standard we typically need the following documents: T4, T5, T3, T4A, T4E, T4A(OAS), T4A(P), TIRF, and your Notice of Assessment.

Does ACCNET support all the tax forms?

Yes, we do.

How long will it take me to prepare my tax return?

All tax returns have different requirements and workload quotas. But we aim to finish the majority of income tax returns within 4-7 days. To be clear, that’s not business days, but 4-7 total days. Yes, we even support our clients during the weekend during tax season.

What makes ACCNET such a fast and easy method?

We are different in that we have combined 25+ years of experience, alongside cutting edge 21st century technology, to service our clients who are on the go. Our innovative online platform is designed to be easy to use, and allows for us to interact with our clients efficiently.

Does ACCNET provide third party filing?

No we do not do third party filing.

Is there a support line I can phone?

Yes, call us during business hours at 1 866-528-8007 and we will be happy to assist you.

How do I get assistance if I need it?

Our online customers can access us through their online dashboard, and get prompt response. We have an online chat system you can use. And we can also schedule phone and video conference calls for those who prefer that method.

What payment methods does ACCNET accept?

We accept all forms of Credit Card or Visa Debit Card payments, and we use Chase as our online payment processor.

Is ACCNET ONLINE secure?

Yes, we took great measure in ensuring that our services are encrypted so that our clients can have peace of mind when dealing with AccNet Online.

Where/How is ACCNET ONLINE storing my data?

We will retain your personal information only for as long as necessary to fulfill the purposes for which that personal information was collected and as permitted or required by law. For example, we will store your social insurance number for the duration it takes to complete your income tax return, usually no longer than 7 days. For more details, please see our privacy policy.

Our Customer Reviews

Serving thousands of clients for the past 25+ years.

We Are Verified To E-FILE!

We Maximize

Your Returns

Unlike users of third-party automated tax software, your AccNet online experience is a service that connects your busy world to our experienced and seasoned real tax professionals. Rest assured that your taxes are efficiently completed with the individualized tax code(s) applicable to you.

Easy-To-Use

Experience

With an internet connection to AccNet’s secure online platform, the processing of your income tax return is quick and easy. Once your tax return is ready, you can file it yourself or have us e-file it to the CRA for free. Get started today in as little as 10 minutes.

Affordability

With as little as $39 per income tax return, we save you time and money. Using tax codes specifically applicable to you, we eliminate the need for you to spend resources on conventional tax methods. Our clients view their relationship with us as an investment, not a cost.

Time Remaining To File Your Taxes (PST)

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Our Features

On-Demand Accounting Consultation

- No more time spent commuting to your accountant

- Quickly and easily do your taxes with the click of a button

- Easily done on your phone, tablet or computer

- Choose from a complimentary or VIP consultation

- Accessible to you from anywhere in the world

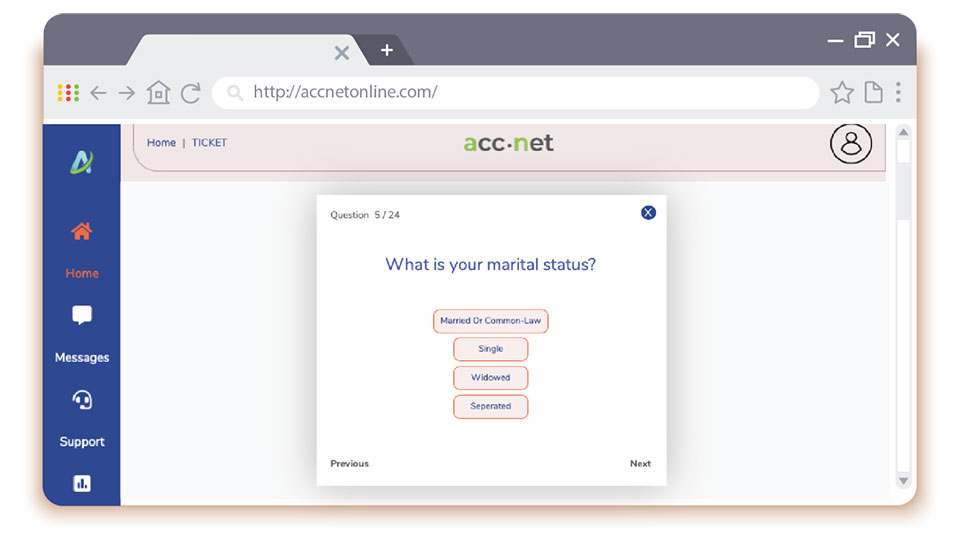

Step-by-Step Guidance

- Log in to your AccNet Online Dashboard

- Explore and experience our intuitive, easy-to-navigate interface

- Answer our questionnaire, requiring only 10 minutes to complete

- Our professionals will then review the results of your individualized questionnaire

- Sit back, relax and let our team prepare your taxes

Easy to Navigate Dashboard

- An easy-to-use platform for anyone, regardless of experience

- Excellent support ticket system

- The ability to view your tax return process

- Quickly file old tax returns

- Easily book consultations

- Pay invoices and more

How to do it yourself 10X better – Back your work with professionals

AccNet is constantly up to date with changing tax rules. Especially in today’s marketplace.

You may pay nothing for do-it-yourself, but you will pay for it in your return. There exist too many individualized tax-code-exceptions not captured by automation.

We offer a complimentary consultation to review your taxes with our tax professionals.

Your tax return is diligently reviewed by our accountants before being filed – without additional charges.

Year after year our clients go from being inefficient taxpayers, to money savvy and efficient taxpayers. Allocating their finances to places that actually help their financial goals. This type of long term goal is not attainable with automation.

How does sign up for FREE, pay when you file work?

- We have no hidden fees. You simply register, and complete the details we need answered.

- Fill out our tax questionnaire

- Upload all your tax documents

- Upload any applicable childcare, medical expense, self-employed expense documents.

- Pay $39 up-front.

- Our accountants get to work and use their expertise to truly optimize your return, sign up for free.

- When your tax return is ready, we have you e-sign the required sections, then we e-file your return with the CRA.

Start Your Tax Return Now

Click here to register and complete your tax returns with ACCNET Online. The process takes as little as 10 minutes to complete with full consultation available for you to speak with a professional accountant.

Toll Free:

Copyright @ 2022. ACCNET ACCOUNTING SERVICES. All Rights Reserved

About Us | About Our CEO | Privacy Policy | Terms Of Service | What Do We Do With Your Information?